Singles day or double-eleven (11.11) is the “unofficial holiday” in China targeting people who are single. Although its origins are vague, Jack Ma and Alibaba have taken the opportunity to offer singles with attractive deals through their online shopping platform Tmall, similar to Amazon. Platforms like JD.com have also followed suit.

Although singles day and the same-name sales event is officially on November 11 (11.11), in order to alleviate the logistical nightmares that can go hand-in-hand with this shopping spree, many platforms have started offering deals as early as mid-October. Similarly, the shopping season which is comparable to black Friday, which started small, has turned into the epitome of consumerism and entertainment world-wide.

What started as a small sales event in 2009 with just 27 brands and totaling 50 million CNY ($7.5mln) sales has emerged as the largest global sales event in many respects.

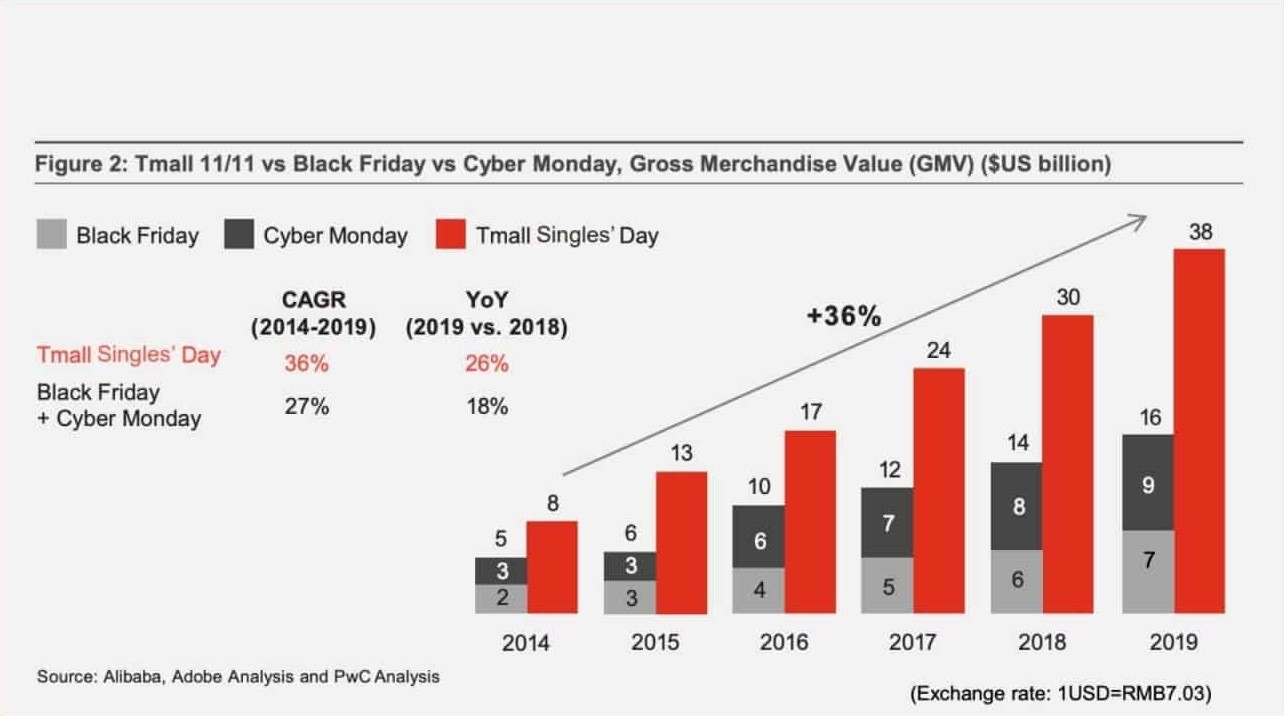

In 2019, total sales for 11.11 totaled $38bln, more than twice the size of Black Friday and Cyber Monday combined ($16.8 bln).

This year (2020) global icons like Mariah Carey and Taylor Swift made appearances in China to celebrate the event. This year (2020), total sales on Alibaba platform alone exceeded $75 bn, although the sales period has been extended to 10 days in 2020 as opposed to 1 day in 2019. Alibaba reported that this is a 26% increase compared to the same 10 days in 2019.

The importance of e-commerce has grown globally due to Covid-19. This is especially true in China where the Ministry of Commerce has reported retails sales in excess of 5 trillion Chinese yuan (or 750 billion USD) for the first half of 2020, up nearly 7.5% from the year before.

The importance of the Chinese e-commerce market for foreign brands has grown steadily. In 2019, Alibaba released a list of 13 foreign brands (like Gap, H&M and Philips) which all totaled more than $140mln in sales during the 11.11 season. Similarly, almost 300 brands exceeded $14mln. In 2020, the focus on foreign brands intensified with 31,000 foreign brands in attendance (of the 250,000 brands participating in 11.11) and 5 bn USD in sales being generated by US brands alone.

You could be forgiven for thinking that success in China comes easily, with a potential market size of 1.3bln consumers, its easy to think that if you drop it, they (consumers) will buy it. However, entering the Chinese market, let alone succeeding in it, is a feat of endurance and perseverance. With the right partners in hand, this can be managed however.

At MOOV, we have helped numerous foreign brands enter the B2C ecommerce market in China on the largest Chinese platforms like Tmall, JD.com and WeChat. Similarly, we have helped setup and strengthen distribution networks to help get their products directly to the consumer or to the distributors. Check out our client case online to see how we helped a Dutch beverage brand enter the local market.

Key issues our clients often face include:

- A lack of local presence either in terms of man-power or legal presence

- No experience or expertise on local channels, customs and practices

- Missing partners and networks in order to transport, sell and distribute

- Lack of visibility in the supply chain

- Limited knowledge on the share of logistics in their value chain

At MOOV, we have helped clients of all sizes and shapes by providing and facilitating:

- Setting up legal entities and providing services like trade finance & leveraging of MOOV import license(s)

- Global, regional and local logistics from the factory to the consumer

- Setting up- and integrating your personalized network of services from packaging & legal support to marketing and running your online store

- Provide visibility and transparency on operations, costs and procedures

- Our expertise and consulting services provides clarity, understanding and structure

When deciding on entering the Chinese market as a foreign brand, it’s important to consider many things. The most important of which includes localizing your product and the experience around it; China is vastly different from countries abroad in many ways. Furthermore, be prepared for unexpected difficulties and road blocks ranging from legal- to mundane daily issues; you will need a local partner to help you navigate these unfamiliar waters. Let us help you explore the local platforms, customs and unravel the (seeming) peculiarities. Finally, be prepared to move fast as China has an incredibly agile and demanding business environment; decisions are made in a matter of days instead of weeks.

Through a combination of our network, experience and infrastructure, we can help you traverse the minefield that is market entry in China irrespective of industry, channel or size. Although it may seem like a long shot from where you may be standing, we can get you started in a matter of weeks rather than months, depending on your business. Please reach out to us either through h.denie@moovlogistics.com, through www.moovlogistics.com or check out our client case online to see how we helped a Dutch beverage brand enter the local market.

Nederlands

Nederlands English

English