Global Market Insights

1) Suez Canal Update: CMA Resumes Transit Amid Ceasefire

CMA CGM’s vessel, Benjamin Franklin (operating on the FAL / French Asia Line 1) completed a transit through the Red Sea on 8 November 2025, returning to Asia via the Suez routing following a recent two-month ceasefire. Meanwhile, the Hapag Lloyd CEO Rolf Habben Jansen stated that despite calmer conditions near the canal, his company sees “no immediate return” to the Suez route until full safety is assured (Reuters, Nov 2025).

Impact: These developments suggest a gradual reopening of the Suez Canal route, but not yet a full-scale return. Many lines remain cautious, meaning alternate routings (via the Cape of Good Hope) may still apply and impact transit times and costs.

2) Vietnam Strengthens Logistics Ambitions With Haiphong’s Rising Role

Vietnam is accelerating investments in port capacity, digital logistics and green infrastructure to become a regional supply-chain hub. Key developments now include the northern port city Haiphong — thanks to its deep-water Lạch Huyện Port, expanding terminals and new inland-waterway and logistics-zone connectivity (NhanDan, Nov 2025). Haiphong is increasingly positioned as a gateway for international trade and northern-Vietnam sourcing, complementing developments in the south.

Impact: This means improved access to northern supply routes, direct container services, and potentially lower logistics lead times.

3) Asia–Europe Ocean Rates Set for Another Increase Amid Capacity Cuts

Ocean carriers on the Asia–North Europe and Mediterranean trades will impose another FAK rate increase on Dec. 1, extending the upward pricing trend that began in October (Journal of Commerce, Nov 2025). Rates have risen roughly every two weeks as carriers continue aggressive blank sailings to manage capacity during tender season. According to Freightos’ Judah Levine, steady pricing reflects these expanded blanking strategies. Forwarders say carriers are aiming to hold rates firm ahead of 2025 contract talks, supported by ongoing congestion and schedule reliability issues. While demand remains moderate, disciplined capacity cuts are expected to sustain rate levels unless year-end volumes soften significantly.

4) China Pauses Special Port Fees on U.S.-Linked Vessels for One Year

China’s Ministry of Transport has suspended special port fees as of 10 November 2025, for vessels linked to the United States for one year (Reuters, Nov 2025). The move aims to ease operational costs, support route planning and cargo operations for shipping companies and freight forwarders, and signals China’s intent to maintain stable trade and supply chain conditions in the China–U.S. corridor. Shipping stakeholders should review port operations and planning while monitoring developments, as the suspension is temporary and will last until November 2026 unless extended.

Port Updates

Port of Dachan Bay (China): In mid-October, the terminal successfully completed its first LNG “ship-to-ship” bunkering operation. This allows international vessels to refuel with clean fuel while unloading cargo, saving over 36 hours for ship operators. With this development, all three major container terminals in Shenzhen now offer LNG bunkering services (ModernTerminals.com, Oct 2025).

Port of Chittagong (Bangladesh): In mid-October, the port authority raised fees by about 41% across 23 service categories—including container handling, vessel services, cargo handling, and waiting/berthing—which triggered protests, mainly due to the vehicle entry fee jumping from Tk 57 to Tk 230 (bdnews24.com, Oct 2025). After two days, that entry-fee increase was rolled back. On 9 November, the High Court placed a one-month pause on the overall 41% tariff hike and asked the port authority to justify keeping it in place (alchempro.com, Nov 2025).

Port of Colombo (Sri Lanka): The port is facing severe congestion due to a surge in cargo volumes, particularly transshipment cargo, combined with adverse weather conditions and high yard utilization. As a result, several container lines have started skipping Colombo — bypassing the port rather than risking long berth waits.

Port of Tanjung Pelepas (Malaysia): On 7 November 2025, the container ship Kyparissia caught fire at the Port of Tanjung Pelepas, resulting in three fatalities and three injuries. The port temporarily suspended operations while fire suppression and cooling measures were conducted by the port fire brigade and local authorities. The vessel, part of MSC’s fleet and leased to Maersk, operates primarily on Asia–Middle East–Europe trades. Preliminary investigations suggest the fire may have been caused by cargo self-ignition, electrical short-circuit, or high operating temperatures; authorities are continuing their inquiry (WorldCargo News, Nov 2025)

Port of Koper (Slovenia): Luka Koper is replacing older diesel RTGs (Rubber-Tyred Gantry crane) with four new electric cranes, boosting efficiency and cutting emissions. Delivery is expected in Q2 2026, strengthening the port’s role as a key Adriatic hub for Central and Eastern European trade (PortTechnology, Nov 2025).

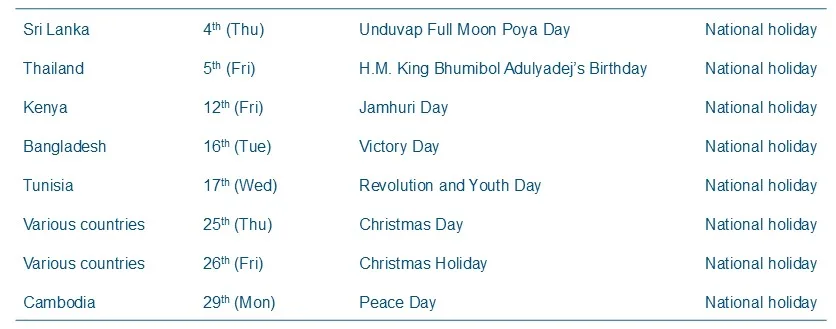

December Holiday

MOOV Highlights

A Message from our Head of IT, Benny Zhang

As your 4PL partner, we’re here to make your supply chain feel simpler, clearer, and more connected. With our smartMOOV platform, we bring all your partners’ data together into one trustworthy source, so you always have a complete and accurate picture of what’s happening. We’re continuously strengthening the platform with predictive insights, AI, and intelligent automation. That means fewer surprises, faster and more accurate documentation handling, and the ability to respond proactively instead of reactively. Together, we can turn visibility into action—building a supply chain that’s not only agile and resilient, but also genuinely collaborative and valuable for everyone involved.

Global Market Insights